The Invesco QQQ Trust (QQQ) is one of the most popular exchange-traded funds (ETFs) tracking the performance of the NASDAQ-100 Index. It offers investors exposure to a diversified portfolio of non-financial companies listed on the NASDAQ Stock Market.

Understanding Sector Allocations

What are sector allocations?

Sector allocations refer to the distribution of investments across different sectors of the economy within an ETF. These sectors can include technology, healthcare, consumer discretionary, financials, industrials, and more.

Importance of sector allocations in ETFs

Sector allocations play a crucial role in determining the overall risk and return profile of an ETF. They allow investors to gain exposure to specific sectors they believe will outperform the market or provide diversification across various industries.

Overview of QQQ Sector Allocations

The QQQ ETF provides exposure to several key sectors:

Technology sector

The largest allocation in QQQ, technology companies such as Apple, Microsoft, and Amazon dominate this sector.

Consumer discretionary sector

Companies like Tesla, Amazon, and Netflix fall under this category, representing consumer spending-driven industries.

Healthcare sector

Biotechnology and pharmaceutical companies like Amgen and Moderna are included in this sector.

Communication services sector

Companies such as Facebook, Alphabet (Google), and Netflix are part of this sector, which encompasses telecommunications and media companies.

Industrial sector

This sector includes companies involved in manufacturing, aerospace, and defense, such as Boeing and Caterpillar.

Financial sector

While QQQ is primarily focused on non-financial companies, it does have some exposure to financial services firms like PayPal and Square.

Consumer staples sector

Staples companies like Costco and PepsiCo are included in this sector, representing essential goods and services.

Energy sector

Although a smaller allocation, QQQ does have exposure to energy companies like Tesla and NextEra Energy.

Utilities sector

Utilities such as Exelon and American Electric Power are part of this sector, providing essential services like electricity and water.

Real estate sector

Real estate investment trusts (REITs) like American Tower Corporation and Crown Castle International are included in this sector.

Top Holdings in QQQ ETF

Importance of top holdings

The top holdings in an ETF like QQQ can significantly influence its performance and risk profile.

Overview of major holdings

As of [insert date], some of the top holdings in QQQ include Apple Inc., Microsoft Corporation, Amazon.com Inc., Meta Platforms Inc. (formerly Facebook), Alphabet Inc. (Google), Tesla Inc., NVIDIA Corporation, and others.

Performance Analysis

Historical performance

QQQ has delivered impressive returns over the years, outperforming many other ETFs and benchmark indices.

Recent trends

Recent trends indicate continued growth and stability in QQQ’s performance, driven by the strength of its underlying holdings.

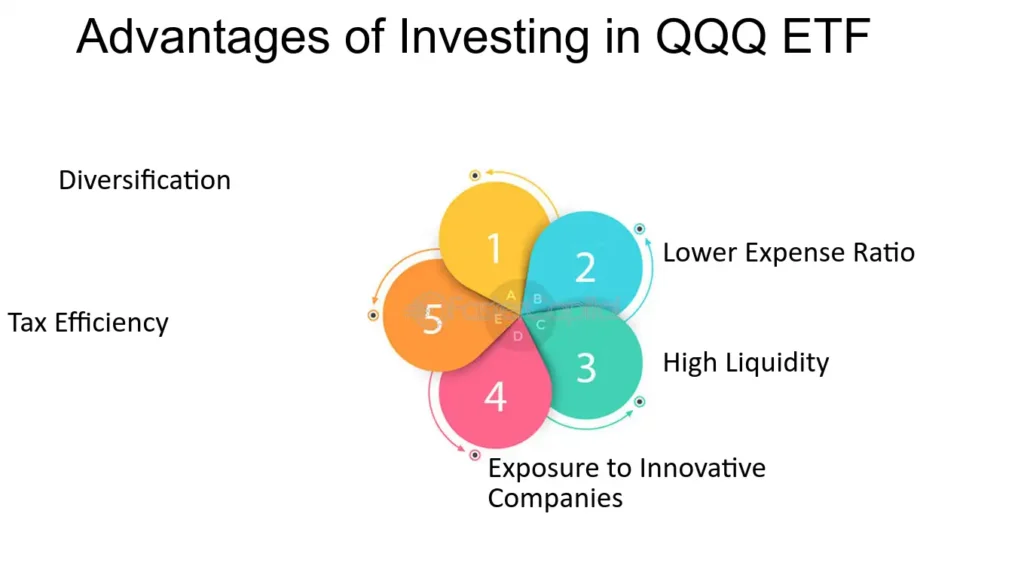

Benefits of Investing in QQQ ETF

Diversification

QQQ offers diversification across various sectors and industries, reducing the risk of relying too heavily on any single company or sector.

Exposure to leading tech companies

With significant exposure to technology giants like Apple, Microsoft, and Amazon, QQQ provides investors with access to some of the world’s most innovative companies.

Growth potential

The technology-focused nature of QQQ positions it well to benefit from ongoing advancements and disruptions in the tech industry.

Low expense ratio

QQQ boasts a relatively low expense ratio compared to actively managed funds, making it a cost-effective option for long-term investors.

Risks Associated with QQQ ETF

Market volatility

As with any equity investment, QQQ is subject to market volatility, which can lead to fluctuations in its value.

Concentration risk

Given its heavy weighting towards technology companies, QQQ is susceptible to downturns in the tech sector.

Sector-specific risks

Investors should be aware of the specific risks associated with each sector represented in QQQ, such as regulatory changes, technological disruptions, and competitive pressures.

Comparison with Other ETFs

Investors may consider comparing QQQ with other technology-focused ETFs or broader market indices to assess its performance and suitability for their investment objectives.

Strategies for Investing in QQQ ETF

Long-term investment

Investing in QQQ with a long-term perspective can help investors ride out short-term market fluctuations and capitalize on the growth potential of its underlying holdings.

Dollar-cost averaging

By investing a fixed amount regularly in QQQ, investors can benefit from averaging out the purchase price over time, potentially reducing the impact of market volatility.

Rebalancing

Regularly rebalancing a portfolio that includes QQQ can help maintain desired asset allocations and manage risk effectively.

Conclusion

In summary, the QQQ ETF offers investors exposure to a diversified portfolio of leading technology and non-financial companies listed on the NASDAQ Stock Market. With its sector allocations and top holdings carefully selected to reflect the performance of the NASDAQ-100 Index, QQQ presents an attractive investment opportunity for those seeking growth and diversification in their portfolios.

Investors often seek the QQQ ETF due to its strong historical performance, particularly in comparison to other ETFs and benchmark indices. The fund’s focus on technology and non-financial companies has been a driving force behind its growth, attracting investors looking for exposure to innovative industries.

However, it’s essential for investors to understand the risks associated with investing in QQQ. Market volatility, particularly within the technology sector, can lead to fluctuations in the fund’s value. Additionally, concentration risk is a factor to consider, as QQQ’s heavy weighting towards certain sectors could expose investors to sector-specific downturns.

Comparing QQQ with other ETFs, particularly those with similar investment objectives, can provide valuable insights for investors. By evaluating factors such as performance, expense ratios, and holdings, investors can make informed decisions about where to allocate their capital.

For those considering investing in QQQ, several strategies can be employed to optimize returns and manage risk effectively. Long-term investment strategies can capitalize on the growth potential of QQQ’s underlying holdings, while dollar-cost averaging can help mitigate the impact of market volatility. Regular rebalancing can also ensure that the portfolio remains aligned with the investor’s objectives and risk tolerance.

Unique FAQs

- Is QQQ only suitable for tech-savvy investors?

- While QQQ has significant exposure to the technology sector, it’s suitable for any investor looking to diversify their portfolio with leading companies listed on the NASDAQ Stock Market.

- How often does QQQ rebalance its holdings?

- QQQ undergoes periodic rebalancing to ensure that its holdings reflect the composition of the NASDAQ-100 Index. The frequency of rebalancing may vary but typically occurs quarterly.

- Can I invest in QQQ through a retirement account?

- Yes, QQQ can be purchased through various retirement accounts such as IRAs and 401(k) plans offered by brokerage firms.

- What are the tax implications of investing in QQQ?

- Investors should consult with a tax advisor to understand the specific tax implications of investing in QQQ, including any potential capital gains taxes associated with buying and selling shares.

- Does QQQ pay dividends to investors?

- Yes, QQQ does distribute dividends to investors, although the yield may vary depending on the performance of its underlying holdings.

- Can I trade QQQ options or futures?

- Yes, investors can trade options and futures contracts on QQQ, providing additional flexibility for hedging or speculative purposes. However, it’s important to understand the risks and complexities associated with derivatives trading.

- Does QQQ provide exposure to international markets?

- While QQQ primarily focuses on U.S.-listed companies, some of its holdings may have international operations or exposure. However, investors seeking broader international diversification may need to consider other ETFs or investment vehicles.

- How does QQQ’s performance compare to the broader market indices like the S&P 500?

- QQQ has historically outperformed broader market indices like the S&P 500, driven by its heavy weighting towards technology companies. However, past performance is not indicative of future results, and investors should conduct thorough research before making investment decisions.

- Can I invest in QQQ through a robo-advisor platform?

- Yes, many robo-advisor platforms offer QQQ as part of their investment portfolios. Investors can typically choose their desired allocation to QQQ based on their risk tolerance and investment objectives.

- What is the minimum investment required to buy shares of QQQ?

- The minimum investment required to buy shares of QQQ varies depending on the brokerage platform used. Some platforms may allow investors to purchase fractional shares, enabling them to invest smaller amounts in QQQ.

Leave a Reply